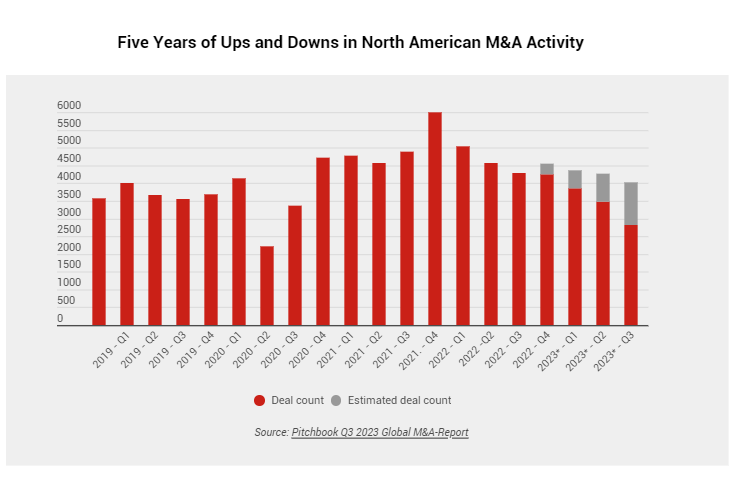

The last five years have witnessed dramatic peaks and troughs in M&A activity. In 2019, we observed strong deal flow fueled by economic confidence, low-interest rates, and sponsor-backed deals. However, early in 2020, almost all but the boldest acquirers halted acquisitions when COVID hit. Deals and deal multiples made a triumphant comeback in 2021, as private equity groups and strategic buyers sought to catch up and rebalance their portfolios for a post-COVID world.

In 2023, there was a significant drop-off in acquisition activity, particularly in larger deals. Central banks raised interest rates in an attempt to combat inflation, and a series of bank failures, such as the Silicon Valley Bank, narrowed funding options. Simultaneously, concerns about economic uncertainty continued to loom large in the minds of business leaders, making them more hesitant to embrace the risks associated with acquisitions.

Next week, we’ll release our predictions for middle-market M&A in the coming year. This week, let’s pull back the curtain on the factors that shape M&A deal activity.

10 Key Factors that Drive M&A Activity

M&A activity is influenced by various factors, and these factors impact different sectors and buyers in unique ways. Let’s explore ten of the most critical ones:

- Interest Rates: Lower interest rates make borrowing cheaper, encouraging companies to finance acquisitions. Conversely, higher interest rates increase the cost of debt-funded M&A, reducing returns. The Federal Funds Effective Rate, which remained near zero for most of 2020 and 2021, has now climbed to 5.33%, significantly cooling M&A activity.

- Economic Confidence: Confidence in economic conditions can stimulate M&A activity. The monthly Business Confidence Index (BCI) has witnessed significant fluctuations over the past four years, with business confidence consistently trending downwards since March 2023, despite positive macroeconomic data like GDP growth.

- Market Conditions: Bullish stock markets boost the valuation of publicly traded companies. Those using their stock for acquisitions gain more leverage in the acquisition process.

- Industry Consolidation: In fragmented industries, companies pursue M&A to gain market share or reduce competition. Healthcare, for instance, has seen substantial consolidation as corporations and private equity groups consolidate fragmented healthcare providers for greater efficiency and potential value.

- Technological Advancements: The emergence of new technology that generates revenue or enhances business efficiency is a critical driver of M&A. The rise of software-focused businesses has been a pivotal macro trend shaping M&A activity, making technology companies prime targets.

- Regulatory Environment: Changes in regulations can either encourage or discourage M&A. Stringent antitrust laws, for example, might dampen M&A activity, especially for larger deals.

- Tax Considerations: Tax laws and incentives can significantly impact M&A deals.

- Availability of Financing: Beyond interest rates, the overall availability of credit affects M&A activity. Following the collapse of Silicon Valley Bank and several smaller banks in 2023, many banks and credit unions scaled back their lending activities to strengthen their balance sheets.

- Cross-border Opportunities: Globalization and the opening of international markets can lead to increased cross-border M&A. However, economic nationalism, which saw a rise during the Trump administration (and to a lesser extent during the Biden administration), may have had a cooling effect on US companies’ acquisition of foreign businesses.

- Private Equity Group Activity: The level of activity and available capital in private equity can drive M&A. Private equity groups (PEGs) and their portfolio companies have become dominant players in M&A, with sponsor-backed deals accounting for over 33% of total deals through the end of Q3 2023 (source: Pitchbook).

The significance of these factors varies based on market and regulatory conditions, requiring constant monitoring to gain a comprehensive understanding of the middle-market M&A landscape.

Stay tuned to CNP for regular updates on the M&A world, with a particular focus on the middle-market.

CNP – We Know M&A