Are you wondering what 2024 will bring for M&A? Well, here goes…

- Summary (the 30-second read)

- The fundamentals for a strong year of North American M&A activity in 2024 are in place. Record amounts of undeployed capital are in the hands of corporate acquirers and private equity.

- We therefore predict that 2024 will see a marked recovery in middle market and large cap M&A, albeit gradual.

- Valuations will rebound, but the balance of power in many sectors will still favor the buyer.

- Private equity will regain momentum, but we expect the ‘higher-for-longer’ interest rate environment to temper this. Smaller sponsor deals and a focus on organic growth continue.

- Alternative deal structures (seller notes, earnouts, buyer equity, etc.) will remain a common feature of the 2024 deal landscape, particularly in the lower middle market. Similarly, private debt will be an essential supplement to bank lending for M&A.

- As interest rates squeezes investment returns, buyers will place renewed focus on downside risk. Thorough due diligence, risk transfer and comprehensive insurance cover are the order of the day!

- Do not expect to see a flurry of AI deals in 2024: most of these businesses are too immature for the risk appetite of many buyers (with the exception of VCs). Do, however, expect artificial intelligence to be a feature of the deal process, as sophisticated buyers increasingly employ AI-powered tools.

- Overall, we see significant opportunities for buyers in 2024, especially those who have done their homework and can bring creative deal structures into play.

Read on for details, data, and insight.

- Context: How We Got Here

Before we turn our attention to the M&A terrain of 2024, it’s worthwhile spending a few minutes looking in the rearview mirror. The market dynamics of years past provide some important context…

The leveraged-buy-out (LBO) boom of the 1980s established M&A as a key tool (now perhaps the key tool) by which North America’s businesses drive nonorganic expansion. The striking growth in M&A has escalated significantly in the past two decades. In just the last 15 years, M&A by middle-market & large-cap companies have more than tripled. In the year before the 2008 financial crisis, PitchBook tracked ~1,100 deals per quarter for the 12 months ending in Q3 2023, which had ballooned to over 4,300!

The recent growth in acquisitions has been driven by cheap debt (i.e. low interest rates), the rise of private equity groups (‘PEGs’ or ‘sponsors’), the expansion of the technology sector, the consolidation of mature markets, globalization, and deregulation.

While the long-term trend has increased deal-making, M&A has been on a roller coaster ride in recent years. Pre-pandemic activity was at record levels, but nearly all deal activity ceased in Q1 2020 as investors scrambled to determine what COVID-19 meant for future investments.

Deals and deal values made a triumphant comeback in 2021, as PEGs and strategic buyers played catch up and sought to rebalance their portfolios to a post-COVID world. Strong activity continued into 2022; PitchBook tracked a record number of middle-market and large cap deals in the final quarter of 2022 – 5995 in total. This raised hopes that 2023 would be another strong year for M&A.

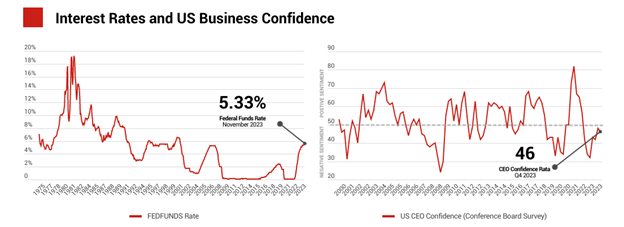

That was not to be. The Fed’s interest rate hikes, concerns about geopolitics, and flagging business confidence intervened to chill deal activity. Concerns of economic uncertainty continued to loom large in the minds of business leaders, making them hesitant to embrace the risks associated with M&A. Deal headwinds increased following a series of bank failures (most notably Silicon Valley Bank) resulted in lenders cutting lending to shore-up balance sheets, in the process significantly narrowing credit options for buyers.

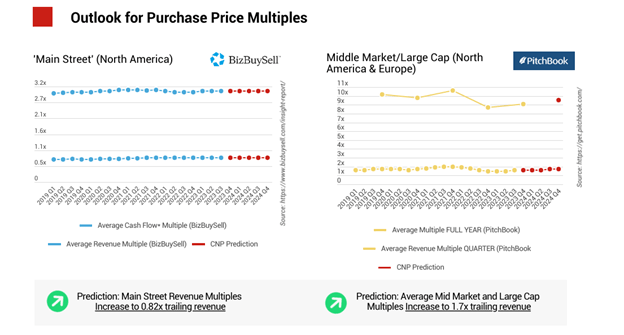

Midmarket & large cap deal flow dropped approximately 10% quarter-over-quarter through Q3 2023. Activity varied significantly by industry, and some more traditional sectors (energy & resources; healthcare; financial services) were more resilient while tech M&A cratered, dropping more than 20%. Average purchase price-to-earnings multiples for the trailing twelve months through Q3 2023 remained in line with 2022, at 8.2 x (PitchBook).

Corporate buyers took a different approach to PEGs last year with the average EV/EBITDA multiple paid by for strategic M&A increasing. Average EV/EBITDA multiples paid in sponsor-backed deals declined (not surprisingly). The increasing cost of debt squeezed the return on investment (ROI) for buyers who rely on leverage to get deals done, such as many PEGs. Some sponsors chose to keep much of their ‘powder dry’ while others shopped for smaller targets (which typically command a purchase price lower multiple). The resulting reduction in competition for deals strengthened the hand of buyers.

2023 also saw a proliferation of alternative deal structures, including seller finance, necessary to bridge valuation gaps between buyers and sellers or to simply fund the deal.

So, what should we expect in 2024…

- M&A Activity Recovers, Gradually

We expect a marked, though gradual, upswing in acquisitions during 2024.

The foundations are present for a resurgence in M&A, both on the demand side (i.e., capital to be put to work) and supply side (i.e., companies ready for ownership transition) … Firstly, the preeminence of M&A as a tool for growth has not and will not change.

Second, private equity’s fabled mountain of dry powder (i.e., undeployed investment capital), sits at ~$1.4 trillion, a near-record level (PitchBook). Additionally, corporate cash reserves have swelled significantly. In the United States, these reserves hit a historic high of over $4.1 trillion in the second quarter of 2023 (Carfang Group). When funds held abroad are included, this total expands to approximately $5.8 trillion (KelloggInsight).

Third, there is a significant ‘overhang’ in unsold businesses. As many as 13 million small and medium-sized businesses owned by Baby Boomers will need to go through an ownership transition in the next 10 years. The passage of time will increasingly push many of these folks rapidly toward selling. Also in the picture is a significant backlog in private equity companies that must come to market. The average holding period for buyout investments among US and Canadian private equity groups jumped to 7.1 years as of Nov. 15, 2023, the longest hold in more than two decades (Preqin Pro)!

Corporate simplification – strategic and otherwise – will also drive divestitures. 2024 will see a continued trend of corporate simplification through divestitures and strategic separations, driven by a need to reduce portfolio complexity, to adapt to a changing macroeconomic environment, and to focus on core operational strengths.

In mid-December, the Fed signaled its intent to cut interest rates in 2024. Any rate reduction will provide some respite to leveraged buyers, but by signaling an end to rate increases, the Fed also eases uncertainty/concerns about future rate rises. What’s more, as banks bolster their balance sheets, funding options will once again open up.

We believe, however, that the recovery in M&A activity will be only gradual. Interest rates are unlikely to return to past lows in the foreseeable future. Further, many buyers will remain cautious. For some, a relentless bombardment of partisan news has almost entirely decoupled their perspective on the economy from objective indicators of the economy’s health; many of which (e.g., GDP growth, Unemployment, Housing Starts, the Stock Market) point to a strong economy going into 2024. For others, the 2024 election threatens further dysfunction to the US government (at least at a federal level) division of the US citizenry.

- Purchase Prices Increase as More Buyers Return

As more buyers return to the market/find funding for more deals, average purchase prices will be pushed up. We expect deal valuations in middle-market & large-cap businesses will align with those seen in late 2022. For smaller, ‘main street’ businesses we expect deals values to remaining reasonably flat, with a slight increase in the year’s second half.

Valuations will not be uniform across sectors. In sectors and market segments that have remained popular with buyers – such as manufacturing and natural resources – we expect to see an outsized increase. We also expect multiples paid for tech businesses to rebound with activity.

Expect a continued, marked shift toward “older economy” sectors like industrials, materials, power, and natural resources, partly as a response to post-COVID trends and sustainability agendas. Natural resources are anticipated to see continued M&A activity.

- Private Equity Regains Momentum

Private equity, with its record reserves of dry powder, will be more active in 2024 mainly as interest rates stabilize and exit strategies, such as IPOs, begin to look more attractive. We wait to see which parts of the economy will attract the attention of sponsors, but it is likely that fragmented sectors that can be ‘rolled up’ will be targeted, as has been the case in the past.

Borrowing costs and market uncertainties, to which sponsors are particularly prone, will temper a resurgence in deal-making. PEGs will likely continue to look at more modest acquisition targets and rely more heavily on organic growth to achieve ROI objectives.

Private equity faces headwinds beyond interest rates: an often-challenging fundraising environment, additional regulation, and increased competition for deals as sponsor-backed businesses compete not just with each other but with deep-pocketed corporates and, increasingly, individual-funded searchers.

Expect private equity exits to recover as sponsors sell the businesses that they held on to in 2023.

- Alternative Deal Structures Will Remain a Regular Feature

Deal structures that include an element of seller finance, earnouts, buyer equity and other alternatives to a pure cash offer, will remain common in the 2024 deal terrain.

While sellers typically prefer to be paid entirely in cash and receive the entire purchase price when the transaction closes, in many segments of the M&A market, buyers enjoy the upper hand in negotiations. For a buyer, the opportunity to reduce the cash element of the purchase price, or at least defer it, is welcome, particularly in a higher interest rate environment. Banks’ inclusion of debt service coverage (‘DSC’) ratios has also pushed deals towards seller finance (often referred to as ‘seller notes’).

While not their optimal deal structure, sellers (and their representatives) are advised to seriously consider these alternative structures, when offered. A seller may obtain a higher purchase price by agreeing to an earnout or seller notes. For some sellers, these structures will make the difference between selling their business or not. Deferring receipt of part of the purchase price may also have tax benefits to the seller, depending on their personal tax situation.

Warren Baas, a senior loan officer at specialist SBA lender Live Oak Bank, observed: “I am seeing more sellers’ representatives becoming open to alternative structures. The bank is now championing a performance-based seller financing model, where needed. This can help bridge a gap between a seller that seeks to justify the value of the business based on projected future earnings and a buyer that wants to mitigate the risk that those earnings do not materialize because, for example, a key customer is lost. In the situation where the performance metric is not met, the payments to seller are deferred until the next measurement period, leaving enough cash flow to cover just the SBA loan obligation.”

In the lower middle market, we expect more than a third of deals to employ seller finance, an earnout, or some other form of alternative deal structure.

It is not just the frequency of these alternative structures that is rising, but their prominence in the overall deal structure. For example, SRS Acquiom reports ”prior to the pandemic, the median size of earnouts was approaching as low as 18% (as a percentage of the up-front consideration paid at closing) and for the last two years, plateaued around 30% after a COVID peak of 38% in 2020. 2023 deals with earnouts come in higher—somewhere north of 40% to date.”

- ‘Higher-for-Longer Interest Rates’ Place Renewed Focus on Downside Risks

More expensive debt squeezes potential the ROI for buyers. If a major risk event materializes, there is also a greater risk that returns will be wiped out completely. This dynamic will encourage thorough due diligence, done at a measured pace.

Expect to see a continued shift towards risk-based diligence (and many will seek help from risk advisory professionals). Buyers will attempt to ensure contingent risks identified via diligence remain with the seller and look for appropriate insurance cover for potentially catastrophic events.

Risk advisory lead at McGriff, says that “as the margin for error shrinks, protecting against catastrophic losses through risk transfer will be tremendously important for company financials. A partially uninsured loss of significant magnitude can trigger noncompliance with debt covenants, negatively impact EBITDA, or worse. Benchmarking insurance limits and evaluating potential claim scenarios with an M&A-focused risk advisor during the due diligence process can prevent a major headache down the road.”

Cybersecurity risks will be increasingly in focus during the deal process and the integration of acquired businesses. The Conference Board’s CEO confidence survey for Q4 found that cyber risk was at the top of the list of CEO’s worries, with 60% of CEOs surveyed considering it would have a “High” potential impact on their industry.

Jeff Baker, CTO at security-focused managed security service provider Socium Solutions, argues that “understanding IT-related risk, how risk is being managed within an organization, and alignment to a compliance framework will continue to gain momentum… To support this, IT skill sets and budgets will require a boost, especially considering advancements in AI and machine learning, which have the potential to create game-changing capabilities for adversaries. Understanding and managing third party risk will be a critical sub-set of IT due diligence and risk management in the M&A context.”

With lingering concerns over the economy’s outlook, regulatory uncertainty, and geopolitical tensions, due diligence and integration planning focus on the financial flexibility of acquired businesses. Buyers will favor flexible cost structures and businesses with low capital intensity.

- And Let Us Not Forget (Yes, You Guessed It!) AI!

Artificial intelligence was the #1 tech and business story of 2023. But do not expect to see a flurry of machine learning or natural language processing acquisitions in 2024! Most companies that might leverage AI are still trying to figure out how AI technologies, such as large language models, that have recently become prominent can really help. Where the AI technology is already being commercialized, it is by businesses that are very early in their lifecycle, meaning that a potential buyer faces a significant risk of overpaying or buying something that will not align with its longer-term strategy. Instead, expect venture capital firms to be the ones that dominate capital investment in AI in 2024.

Where AI is likely to make a mark in M&A is the acquisition transaction process. Risk factors, such as fraud and cyber risk, will become more fraught as bad actors employ AI to obtain money, information, and control of IT assets, etc. Countering this, expect AI to be increasingly used in the evolution of countermeasures. AI also holds the promise of reducing the cost and time of getting a deal closed; tools like Thompson Reuters’ HighQ document review tool can save hundreds of hours of lawyer/paralegal time that would have previously been devoted to contract review during confirmatory due diligence.

M&A target search is one area that holds a lot of promise. The CNP team trialed two acquisition target identification tools this year, both of which were disappointing. They were plagued by a challenge that faces existing technology: that they are only as good on the quality of information on the internet, which is often out of date, incomplete or simply inaccurate.

Summary

We see a cautious but potentially more active M&A market in 2024. There is significant scope for buyers to create value through mergers & acquisitions in 2024, particularly for those buyers who have done their homework, can bring creative deal structures into play to meet the objective of both buyer and seller, and are ready to act when deal opportunities arise.

A big thank you to Erin York for helping to write this article

If M&A is on your ‘to do’ list for 2024 (or you think it should be), please reach out to me: chrisperfect@conceptandperspective.com +1-281-435-8974 so that we can discuss how Concept and Perspective, LLC can help.